Rare-earth magnet imports to the U.S. from China surged 660% in June as firms scramble to secure vital components used in EVs, wind turbines, and AI tech amid trade shifts.

Table of Contents

U.S. Firms Scramble to Secure Rare-Earth Magnets — Imports from China Surge 660%

Introduction

The global race for technological dominance has added a new twist in June 2025, as rare-earth magnet imports from China to the United States surged by a staggering 660%. This dramatic increase is a clear signal that U.S. firms are scrambling to secure these critical components amid ongoing supply chain constraints, international trade tensions, and geopolitical maneuvering. Rare-earth permanent magnets are essential for a range of advanced technologies, and China holds near-total control over this strategic resource. With the U.S. depending heavily on imports, any disruption can send shockwaves across industries.

What Are Rare-Earth Magnets and Why They Matter

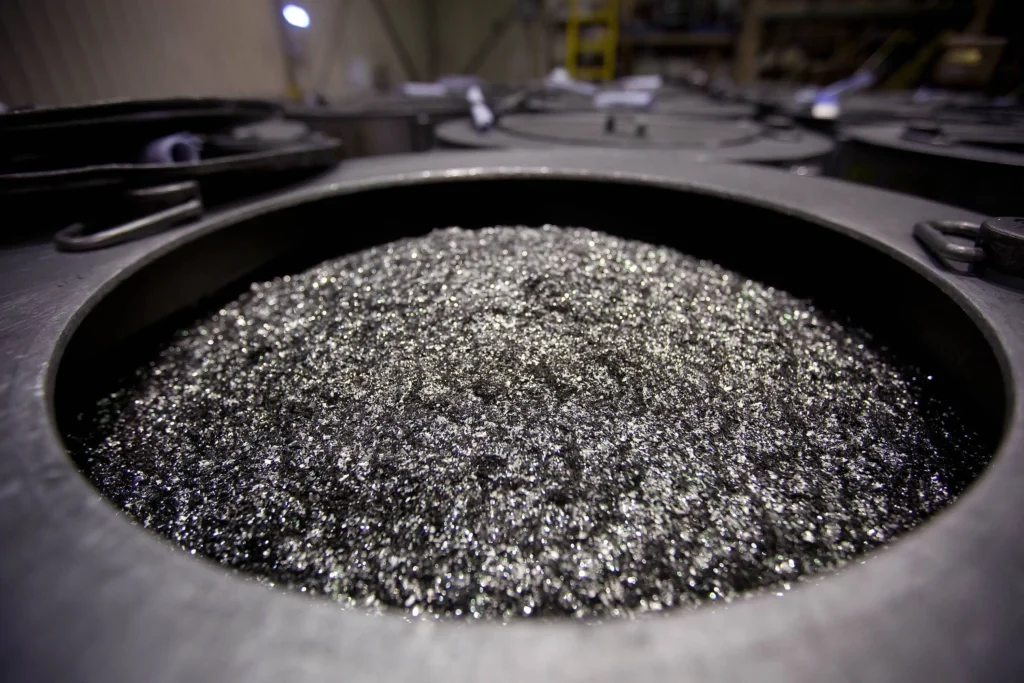

Rare-earth magnets, particularly Neodymium Iron Boron (NdFeB) magnets, are among the strongest types of permanent magnets ever created. They are compact yet powerful and used in a variety of high-tech applications such as:

- Electric vehicles (EVs)

- Wind turbines

- MRI machines

- Military hardware

- Smartphones and audio systems

- Robotics and AI systems

The importance of these magnets lies not only in their strength but also in their efficiency in reducing weight and improving energy performance—critical features for modern, green, and compact technologies.

China’s Monopoly on Rare-Earth Magnets

China controls approximately 90% of the world’s production and refining of rare-earth magnets. This dominance was no accident. Since the 1980s, under the leadership of Deng Xiaoping, China identified rare-earth elements as a strategic priority. Massive investments in extraction, refining, and technological infrastructure have put China in a nearly unshakable position.

As a result, China has become the go-to source for companies globally, including those in the U.S., for rare-earth magnets. The U.S., despite its technological advancement, has been slow to develop its domestic capacity for mining and refining rare-earth materials, making it heavily reliant on Chinese imports.

The June Surge: What’s Behind the 660% Spike?

According to China’s General Administration of Customs, the U.S. imported approximately 353 metric tons of rare-earth permanent magnets from China in June 2025. This figure represents a 660% increase from May—a month when imports were notably low due to regulatory constraints.

Several key factors contributed to this sudden spike:

1. Trade Deal Breakthrough

In late May, Washington and Beijing reached a preliminary agreement to ease some restrictions. This included the relaxation of Chinese export controls on rare-earth magnets and a rollback of certain U.S. restrictions on AI chip exports to China.

2. Licensing Relief

Back in April, China had placed strict licensing requirements on the export of several categories of rare-earth magnets. The move was widely seen as retaliation for tariffs imposed by the U.S. on Chinese tech products. As China began approving export licenses again in June, shipments surged.

3. Supply Chain Panic

Many U.S. firms, especially in sectors like automotive and electronics, had been struggling with magnet shortages. These companies jumped at the opportunity to replenish their inventories once restrictions eased, driving a spike in demand.

Global Export Trends: U.S. in Second Place

In total, China exported 3,188 metric tons of rare-earth magnets globally in June. While this marked a 160% increase compared to May, it was still 38% lower than June 2024. Germany was the top destination, with the U.S. in second place.

This indicates a global scramble for rare-earth magnets, not just limited to the U.S. However, the spike in American imports is particularly notable due to the country’s vast manufacturing base and limited domestic production capacity.

Industries Hit Hard by the Shortage

The ripple effects of the earlier magnet shortage were severe. Several European auto-parts suppliers had to halt production due to the unavailability of critical magnetic components. In the U.S., even cutting-edge technology sectors like robotics felt the pinch.

Tesla’s Humanoid Robots

In April, Elon Musk revealed that Tesla’s Optimus humanoid robot production had been disrupted by magnet supply issues. Rare-earth magnets are integral to the robot’s joints and actuators.

Renewable Energy

Wind turbine manufacturers also reported delays, as the magnets are key to converting wind energy into electrical power efficiently.

Military and Aerospace

The U.S. defense sector, which relies on these materials for navigation systems, missile guidance, and secure communication, faced growing concerns about national security vulnerabilities due to overdependence on foreign supply chains.

U.S. Response: Recycling and Reshoring

Recognizing the urgency of the situation, the U.S. has taken several steps to reduce dependence on China:

1. Apple-MP Materials Recycling Deal

Apple recently partnered with MP Materials in a $500 million deal to develop a recycling facility that would recover rare-earth materials from used iPhones and other devices. This move aims to create a closed-loop supply chain within the U.S.

2. Pentagon Investment

The U.S. Department of Defense has invested in MP Materials and other domestic miners. The Pentagon is also offering guaranteed floor prices to encourage investment in rare-earth extraction and processing.

3. Legislative Push

Several bills are currently in Congress aimed at streamlining permitting for rare-earth mining projects and offering tax incentives for domestic manufacturers that use U.S.-sourced magnets.

The Challenge of Breaking Free from China

Despite these efforts, experts warn that building a self-sustaining rare-earth supply chain in the U.S. will take years.

“The separation process is quite complex, and China has a lot of advantages in this after putting in decades of research,” said Yue Wang, a senior consultant of rare earths at Wood Mackenzie.

The refining of rare-earth elements involves environmentally sensitive processes and requires advanced technological expertise, areas where China still holds a commanding lead.

Broader Trade and Geopolitical Implications

The rare-earth magnet saga is a microcosm of larger geopolitical tensions. The interdependence of the U.S. and China in critical tech supply chains raises difficult questions:

- Can national security be preserved while depending on a geopolitical rival?

- How far should governments go in subsidizing strategic industries?

- Will the current trade truce hold, or is this just a temporary pause?

Peter Alexander of Z-ben Advisors summed it up well on CNBC:

“Washington’s latest concessions on tech restrictions reflect just how much leverage China has in this relationship.”

What’s Next?

With the next round of U.S. tariffs and Chinese export policies likely to shift again in the coming months, companies are in a race against time to secure their supply chains.

In the short term, we can expect:

- Continued volatility in rare-earth magnet pricing

- Strategic stockpiling by large manufacturers

- Increased pressure on policymakers to accelerate domestic capabilities

In the long term:

- The U.S. may emerge with a more diversified supply chain

- Recycling and innovation may reduce reliance on mining

- Geopolitics will continue to play a central role in supply chain strategy

Related Posts

- Treasury Secretary Bessent Urges Full Review of the Federal Reserve Amid Growing Tensions

- Colbert’s First ‘Late Show’ After CBS Cancellation: Will He Speak Out?

- Starbucks Reveals Pumpkin Spice Latte Return Date for 2024

Conclusion

The 660% surge in rare-earth magnet imports is not just a trade statistic—it’s a signal of broader structural vulnerabilities in the U.S. industrial base. As America seeks to lead in areas like electric vehicles, AI, and renewable energy, ensuring a secure and stable supply of rare-earth materials will be crucial.

While recent trade concessions have provided temporary relief, the long-term solution lies in strategic investment, recycling innovation, and a renewed focus on supply chain resilience. For now, U.S. firms remain caught in a delicate dance of cooperation and competition with China, racing to secure the tiny magnets powering the future.

FAQs

Q1. What are rare-earth magnets used for?

A: They are used in EVs, wind turbines, medical equipment, smartphones, robotics, and military systems.

Q2. Why is the U.S. dependent on China for these magnets?

A: China controls most of the world’s mining, refining, and manufacturing capacity for rare-earth magnets.

Q3. What is the U.S. doing to reduce its dependence?

A: Investments in recycling, domestic mining, and government support programs are being expanded.

Q4. Will domestic production catch up soon?

A: Not likely in the short term. Experts estimate it could take several years to match China’s capabilities.

Q5. How does this affect the average consumer?

A: Shortages or delays in rare-earth magnets can raise costs and slow production for EVs, tech devices, and appliances.