Trump’s 2025 trade war is driving up food costs. Learn how new tariffs on imports like tomatoes and beef could spike grocery prices by 20% across the U.S.

Table of Contents

📰 Introduction: A Political Power Play with a Price Tag

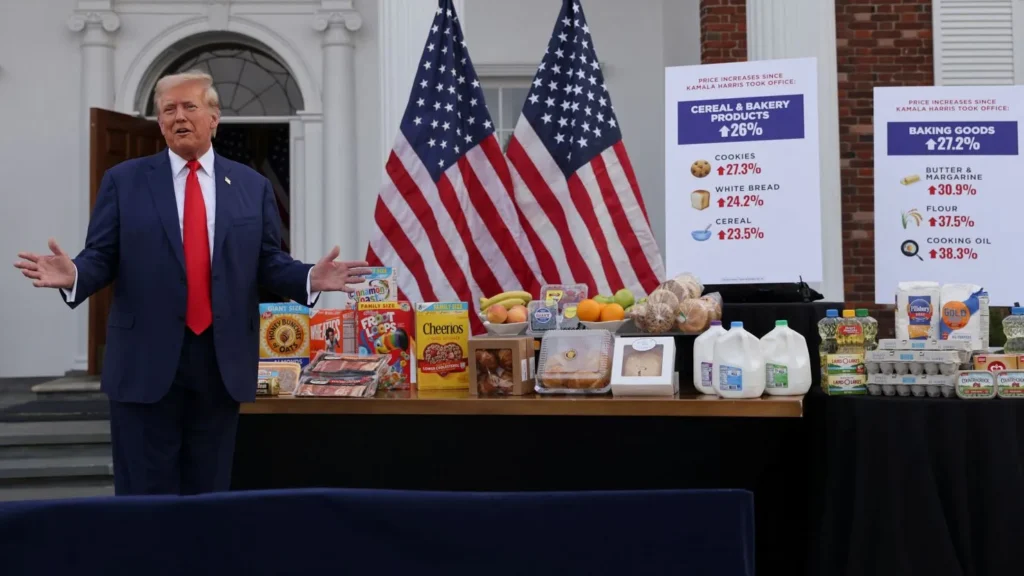

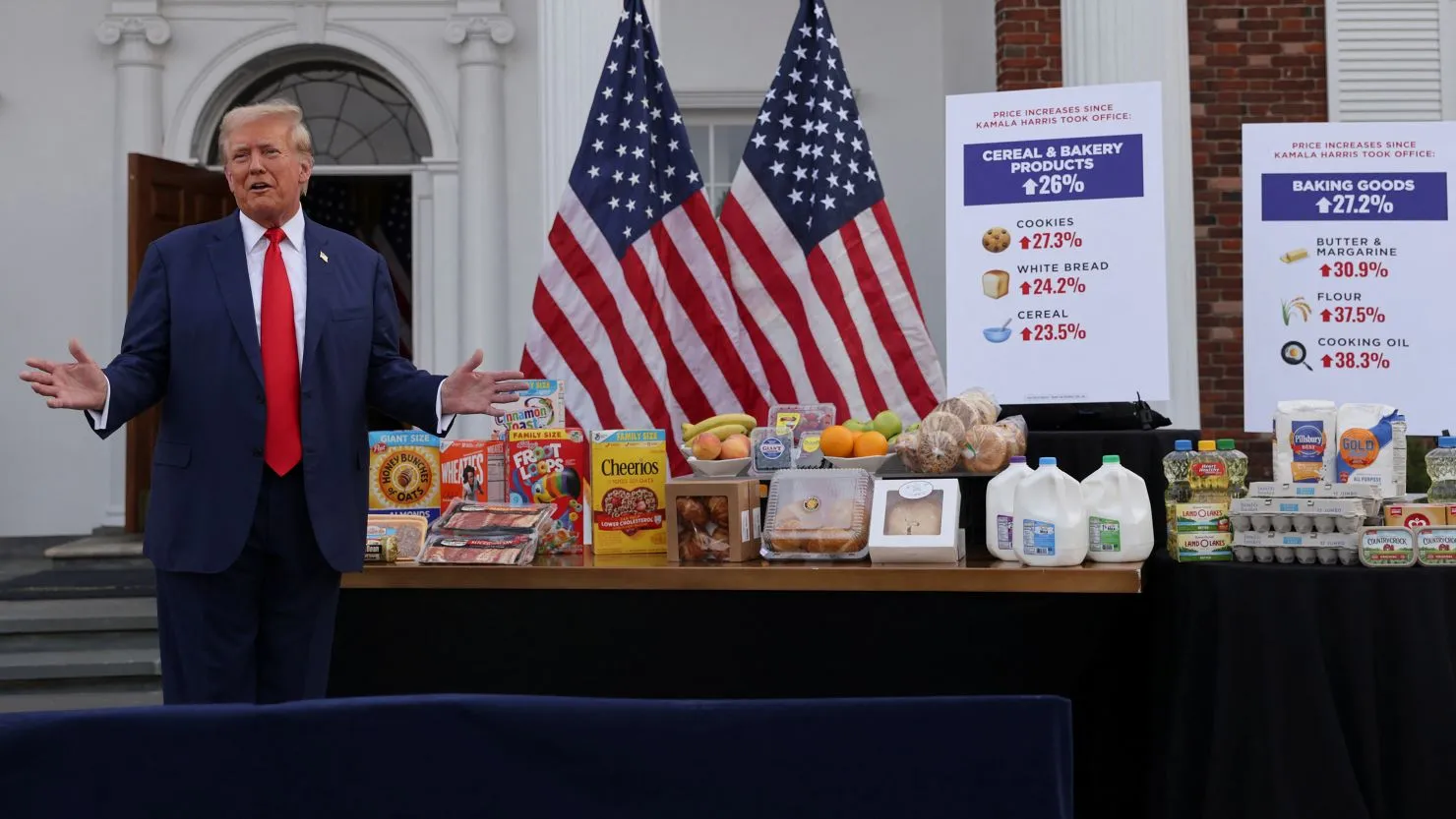

The 2025 Trump administration has reignited its “America First” trade agenda — and this time, your grocery bill may take the hit.

Fresh off re-election, President Trump has imposed sweeping tariffs on food imports from Mexico, Canada, China, and the European Union, citing the need to protect American farmers and reduce trade deficits. But experts warn these protectionist moves could increase the average cost of U.S. groceries by 15% to 20%, hitting working-class families hardest.

🇺🇸 What’s Happening: Tariffs Are Back in a Big Way

Trump’s 2025 trade war strategy is a revival of his 2018–2020 playbook — only now it’s broader and deeper.

🔻 Major 2025 Tariffs Include:

- 17% tariff on fresh tomatoes from Mexico (already in effect)

- 25% tariff on European dairy and processed meats

- 30% tariff on Chinese packaged goods and frozen foods

- 15% tariff on Canadian beef and grain

While the White House claims the move is to protect “American food sovereignty,” economists warn the tariffs will act like a hidden tax on consumers, especially those relying on imported staples.

🧺 How These Tariffs Hit Your Grocery Basket

Let’s break down the real-world impact — aisle by aisle.

🍅 Produce Section

- Tomatoes, peppers, avocados: +15–30%

- Imported from: Mexico

- Reason: Trump’s 17% tariff on Mexican tomatoes disrupts a $3B supply chain. Retailers are already raising prices.

🥩 Meat & Poultry

- Beef and pork: +10–25%

- Imported from: Canada and Europe

- Reason: 15–25% tariffs on premium cuts; U.S. farmers can’t meet demand year-round.

🧀 Dairy & Cheese

- Brie, parmesan, and yogurts: +20–35%

- Imported from: EU

- Reason: 25% tariffs force distributors to source costlier domestic alternatives.

🥫 Canned & Frozen Goods

- Canned mushrooms, frozen seafood, noodles: +12–20%

- Imported from: China and Southeast Asia

- Reason: 30% tariffs on food manufacturing inputs.

💵 Why You’re Paying More — Even for U.S. Products

1. Imported Ingredients Are Everywhere

Even U.S.-made products often depend on imported inputs — spices, packaging, emulsifiers, even seeds. When tariffs hit those, domestic prices also rise.

2. Supply Chain Disruption = Delays + Cost

Tariffs often cause companies to rework entire logistics networks, delaying shipments and raising prices — especially in fresh food sectors.

3. Retailers Pass the Cost to You

Walmart, Kroger, and even Aldi can’t afford to eat the entire cost. As wholesale prices increase, so do consumer shelf prices — and it happens fast.

📈 A Look at the Data: Inflation Pressure Building

According to the Bureau of Labor Statistics (BLS) and U.S. Department of Agriculture (USDA):

| Product Category | Price Increase Expected (Q3–Q4 2025) |

|---|---|

| Fresh Produce | 17–22% |

| Meats | 12–18% |

| Dairy | 15–20% |

| Frozen Foods | 10–15% |

| Overall Grocery Inflation | ~19.6% |

👩👧 Who Will This Hurt the Most?

Tariffs are often branded as nationalistic or patriotic, but the pain lands hardest on:

- Low-income families

- Fixed-income seniors

- Single-parent households

- SNAP (food stamp) recipients

Even a $30/month grocery hike can stretch already thin budgets.

🗣️ What Experts & Economists Are Saying

“Tariffs are taxes — full stop. And when you tax food, you hurt the most vulnerable Americans.”

— Dr. Elena Vasquez, Food Policy Analyst, Brookings Institution

“This could easily become 2018 all over again, but worse. Food prices are a political powder keg.”

— James Keller, Economist, Stanford

⚖️ Trump’s Justification: Protecting U.S. Farmers

The Trump administration insists the tariffs are vital to:

- Stop foreign “dumping” of low-cost goods

- Revive local agriculture

- Balance trade deficits

But critics argue:

- Domestic farmers still rely on foreign labor and inputs

- Trade wars usually lead to price wars, not savings

- Many U.S. farm sectors benefit from exports, not isolation

🌎 Global Blowback

Retaliation Is Already Brewing:

- Mexico threatens tariffs on U.S. corn and soy

- Canada may respond with taxes on U.S. poultry

- China halts large U.S. grain orders

These moves will make American food exports less competitive, potentially hurting the very farmers the tariffs claim to protect.

🧠 What Can You Do as a Consumer?

🛒 1. Shop Smarter

- Compare prices across stores

- Use coupon apps (Ibotta, Honey)

- Look for store brands over imported names

🥦 2. Buy Local When Possible

- Farmers markets are less tariff-exposed

- Seasonal U.S. produce is generally cheaper

💳 3. Budget for Higher Food Costs

- Shift budget from discretionary to food

- Track month-over-month price increases

🔮 What’s Next? Could Prices Rise Even More?

It’s possible. If Trump’s administration follows through on:

- A 30% general tariff on imports from China (under discussion)

- New tariffs on South American goods

- Expanded duties on European seafood

Grocery prices could climb another 5–10% by early 2026.

❓ FAQ: Trump’s 2025 Tariffs & Grocery Prices

Q1: Why is the Trump administration imposing food tariffs in 2025?

A: To protect U.S. farmers and reduce reliance on foreign imports, as part of the “America First” trade strategy.

Q2: Which foods are affected most by the tariffs?

A: Tomatoes, beef, dairy, canned and frozen goods from Mexico, Canada, China, and the EU.

Q3: How much more could I be paying at the grocery store?

A: Experts estimate an average 15–20% increase in grocery bills by late 2025.

Q4: Who is hurt most by these tariffs?

A: Low-income families, seniors, and those on fixed incomes — the very groups most affected by food inflation.

Q5: Can this lead to another trade war?

A: Yes. Several countries are threatening retaliatory tariffs, which could escalate into broader trade conflicts.