Trump takes his fight to remove Federal Reserve Governor Lisa Cook to the Supreme Court. Here’s what it means for Fed independence and the economy.

Table of Contents

Trump Asks Supreme Court to Let Him Fire Fed Governor Lisa Cook

Introduction

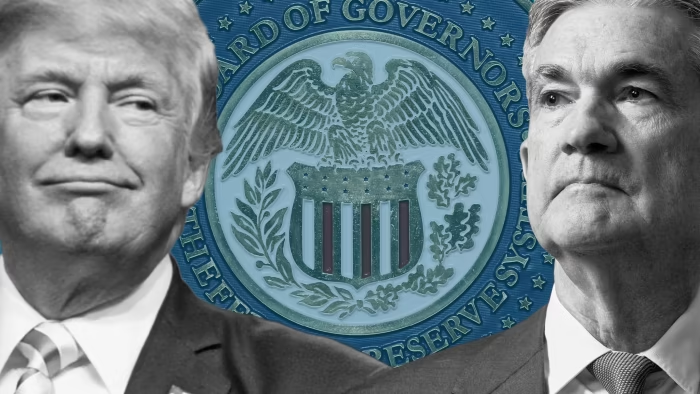

President Donald Trump has escalated his effort to remove Federal Reserve Governor Lisa Cook, filing an emergency appeal to the US Supreme Court. The move comes just a day after the Fed cut interest rates for the first time in months, putting questions of central bank independence and presidential authority front and center. If successful, it would mark the first time in the Fed’s 111-year history that a president has directly removed a sitting governor.

Fed Independence on the Line

The Federal Reserve plays a unique role in shaping US monetary policy. Historically insulated from political pressure, its independence is considered vital for market stability. By challenging Cook’s position, Trump is testing whether the Supreme Court will allow greater presidential power over the central bank.

- The Fed lowered its benchmark interest rate on Wednesday, signaling further cuts ahead.

- Trump has repeatedly criticized Chair Jerome Powell and other Fed officials for not lowering rates fast enough.

- Analysts warn the case could send shock waves through financial markets if Cook is removed.

Why Trump Is Targeting Lisa Cook

The administration alleges that Cook engaged in mortgage fraud by listing two properties as her “primary residence” at different times to secure favorable loan terms. Trump fired her on August 25, but a federal court blocked the move earlier this month, ruling she had been given no due process.

Cook’s attorneys argue that her removal would:

- Undermine Fed independence.

- Disrupt markets and damage confidence in US monetary policy.

- Set a dangerous precedent for political interference in financial regulation.

Legal Arguments Before the Court

The case raises a central question: Who defines “cause” for removal?

- Trump insists that allegations of misconduct justify her dismissal.

- His administration cites a 1901 Supreme Court precedent supporting wide executive discretion.

- Lower courts disagreed, saying Cook has a property right to her position and deserves notice and a hearing.

The outcome could reshape the balance of power between the White House and the central bank.

Market and Economic Implications

Lisa Cook warned that her removal could trigger market instability at a delicate time. The Fed has already been cutting rates to support a weakening labor market, while inflation remains stubborn. Any disruption in Fed governance could:

- Raise borrowing costs.

- Weaken investor confidence.

- Amplify volatility in global markets.

Fed Chair Jerome Powell reiterated that the central bank remains “strongly committed to independence,” even as new Trump appointees join the board.

Related Context: Tariffs Case Looms

The Supreme Court is also preparing to hear arguments on Trump’s use of sweeping global tariffs, another core piece of his economic agenda. The convergence of cases underscores how closely intertwined the Court and the administration’s economic policies have become.

FAQs

Q1. Why is Trump trying to fire Lisa Cook?

Trump alleges Cook engaged in mortgage fraud by misrepresenting her primary residence on loan documents, though courts have not confirmed wrongdoing.

Q2. Has any president ever removed a Federal Reserve governor before?

No. If successful, Trump would be the first president in history to fire a Fed governor.

Q3. How could this affect mortgage rates and borrowing costs?

Market instability from Fed interference could push yields higher, indirectly raising mortgage and credit costs.

Q4. What does this mean for Federal Reserve independence?

Analysts warn that Cook’s removal could weaken the Fed’s independence, making it more vulnerable to political influence.

Q5. When will the Supreme Court hear the case?

The Court has not yet set a full hearing date but is reviewing Trump’s emergency request for immediate removal.

Conclusion

Trump’s legal push to fire Lisa Cook has put the Federal Reserve’s independence under the spotlight at a time of economic uncertainty. The Supreme Court’s decision could reshape not just the central bank but also the balance of power between the executive branch and America’s most important financial institution.

👉 Stay tuned for updates on this historic showdown between the White House, the Fed, and the Supreme Court.