Bond yields drop as labor data weakens. Is the US economy slowing? Here’s what falling Treasury yields mean for growth, inflation & Fed rate cuts.

Table of Contents

Bond Market Signals Fear About America’s Economy

Introduction

The US stock market may be hovering near record highs, but the bond market is sending a very different message. Recent declines in Treasury yields highlight growing concerns about the labor market, inflation, and the Federal Reserve’s next policy move. As investors flock to bonds, the signal is clear: Wall Street is bracing for weaker economic growth ahead.

Why Bond Yields Are Falling

Bond yields, especially the two-year and 10-year Treasuries, are critical indicators of market sentiment.

- Two-year Treasury yield: Tracks expectations for Fed rate policy. Recently fell to its lowest since 2022.

- 10-year Treasury yield: A benchmark for borrowing costs, dipped below 4% for the first time in months.

Lower yields suggest investors expect rate cuts and a slowing economy.

Labor Market Weakness Raises Concerns

Recent government data paints a troubling picture:

- Jobless claims surged, marking one of the largest weekly increases in over a year.

- Unemployment rate rose to 4.3%, the highest since 2021.

- The US economy created 911,000 fewer jobs than previously estimated.

“The bond market is acknowledging that job creation, a powerful engine of the US economy, is decelerating,” said Chip Hughey of Truist Advisory Services.

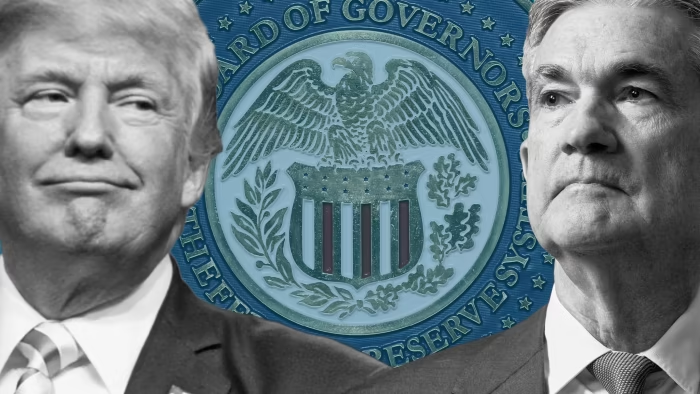

Fed Policy Outlook: Rate Cuts Incoming?

The Federal Reserve has held interest rates steady since December, but markets now expect multiple cuts:

- Deutsche Bank forecasts three quarter-point cuts in September, October, and December.

- Bank of America expects at least two rate cuts this year.

- Traders see a 96% probability of a September cut.

Lower rates may ease borrowing costs, but they also underscore fears of slower growth and rising risks.

Consumer Spending: The Bright Spot

Despite labor market weakness, consumer spending remains relatively strong:

- Commerce Department data shows 0.5% growth in spending from June to July.

- GDP growth in Q2 was stronger than expected.

However, economists warn that sustained labor market weakness could eventually slow household demand.

Inflation Still in Focus

While the Fed watches jobs closely, inflation hasn’t cooled enough:

- Core CPI rose 3.1% YoY in August, well above the Fed’s 2% target.

- Tariffs and higher business costs continue fueling prices.

This leaves the Fed balancing two risks: weak job growth vs. sticky inflation.

Key Takeaways: A Balancing Act

- Bond market signals caution about US growth.

- Labor market is weakening, unemployment rising.

- Fed rate cuts are almost certain, but their scale remains unclear.

- Consumer spending is holding up—for now.

- Inflation complicates policy decisions.

FAQs

Q1: Why are Treasury yields falling in 2025?

Treasury yields are dropping because investors expect Fed rate cuts amid slowing job growth and weaker labor data.

Q2: How does a decline in the 10-year yield affect Americans?

A lower 10-year yield usually reduces mortgage rates and borrowing costs, but it also signals concerns about economic slowdown.

Q3: Will the Fed cut interest rates this year?

Yes, markets expect multiple rate cuts in 2025, starting with a likely quarter-point cut in September.

Q4: Is the US economy heading for a recession?

Economists suggest a slowdown, not a full recession. However, risks remain if the labor market continues to weaken.

Q5: What role does inflation play in Fed decisions?

Persistent inflation above the Fed’s 2% target complicates rate-cutting decisions, as easing too much could reignite price pressures.

Amazon Ends Prime Invitee Perk: Free Shipping Sharing Stops

Conclusion

The bond market is flashing warning signs that the US economy may be losing momentum. Falling yields, weaker labor data, and expectations of Fed rate cuts highlight a critical turning point for policymakers and investors alike. For now, consumer spending is keeping growth afloat, but all eyes remain on the Federal Reserve’s next move.