If Donald Trump gains control of the Federal Reserve, experts warn of inflation, market turmoil, and global economic shocks. Here’s what history tells us.

Table of Contents

What Happens if Trump Gets Control of the Federal Reserve?

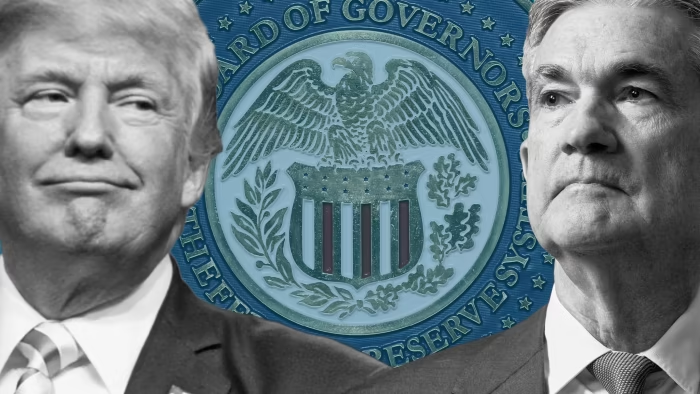

The U.S. Federal Reserve has always been seen as an independent pillar of the global financial system. But former President Donald Trump’s escalating tensions with the Fed — and his attempts to influence interest rates and monetary policy — are raising serious concerns on Wall Street and across the globe.

Recent developments, including Trump’s move to fire Fed Governor Lisa Cook and his ongoing criticism of Fed Chair Jerome Powell, have triggered warnings from economists, investors, and central bankers worldwide. Many fear that if Trump gains more control over the Fed, it could lead to inflation, financial instability, and global market disruptions.

In this article, we’ll break down:

- Why Trump wants control of the Fed

- Historical examples from Turkey, Argentina, and the U.S.

- What experts predict for markets, inflation, and the dollar

- How global economies could be impacted

Why Trump Wants to Influence the Fed

Trump’s dissatisfaction with the Fed isn’t new. He has repeatedly criticized Powell’s interest rate policies, demanding faster cuts to stimulate economic growth ahead of the 2024 election.

According to the White House, Trump believes his policies have already reduced inflation and that lower interest rates are now necessary to:

- Boost consumer spending

- Strengthen GDP growth

- Support American families facing rising costs

However, former Treasury Secretary Janet Yellen warned that direct interference could backfire:

“It’s really important for Americans to understand how dangerous this is,” Yellen said in a recent interview.

Historical Warnings: Turkey’s Economic Crisis

If Trump succeeds in gaining influence over the Fed, Turkey offers a cautionary tale.

President Recep Tayyip Erdoğan repeatedly pressured Turkey’s central bank to keep rates low despite soaring inflation. Between 2019 and 2021, Erdoğan fired multiple central bank governors who resisted his policies.

The Result?

- Inflation soared from 16.7% to 85.5% by late 2022

- The Turkish lira collapsed

- Mortgage rates spiked above 40%

- Over 9 million low-income workers were left struggling

This shows how political interference in central banking can lead to runaway inflation and economic instability — a scenario some fear could happen in the U.S. if Trump takes similar actions.

Argentina’s Hyperinflation Crisis: Another Warning

Argentina’s struggles highlight another risk of undermining central bank independence. Over the past decade, Argentina’s government repeatedly forced its central bank to print money to finance deficits, leading to:

- Eight central bank chiefs removed since 2013

- Hyperinflation peaking at 292% in April 2024

- A collapsing currency and a massive loss of investor confidence

Since taking office in 2023, President Javier Milei reversed this approach and restored central bank independence. Inflation has since dropped to 36.6%, proving how critical it is to keep monetary policy free from political manipulation.

Lessons from U.S. History: Nixon’s Influence on the Fed

The U.S. has faced similar challenges before. In the early 1970s, President Richard Nixon replaced Fed Chair William McChesney Martin with loyalist Arthur Burns, pressuring him to keep interest rates low.

The Fallout

- Inflation surged from 3.3% in 1971 to 11.8% by 1974

- The U.S. faced a painful boom-bust cycle

- Investor confidence in the dollar weakened

Economists fear that if Trump gains similar influence, history could repeat itself — only this time, the stakes are even higher due to the global dominance of the U.S. dollar.

Potential Impacts If Trump Controls the Fed

If Trump gains significant influence over the Fed, experts warn of three major risks:

1. Rising Inflation

Lowering rates too aggressively could overheat the economy, leading to price spikes similar to Turkey and Argentina.

2. Market Volatility

Wall Street would likely react sharply, with investors fearing an unstable monetary policy environment.

3. Global Economic Disruptions

Because the U.S. dollar underpins global trade, any loss of confidence in Fed independence could trigger:

- Capital outflows from U.S. assets

- Volatility in emerging markets

- A potential global recession

What Experts Are Saying

- Davide Romelli, Trinity College:

“Every time there’s perceived political pressure on a central bank, inflation expectations rise — and that can destabilize economies.” - George Saravelos, Deutsche Bank:

“If a 1970s-style scenario unfolds in today’s interconnected world, the fallout would be far more severe.” - Carola Binder, University of Texas:

“Even if the Fed acts based on data, political interference will create distrust — which could be hard to reverse.”

Conclusion: The Stakes Are Global

While Trump argues his policies will stimulate growth, history suggests that political control of the Fed carries massive risks.

From Turkey’s lira collapse to Argentina’s hyperinflation and Nixon’s 1970s inflation spike, the evidence is clear: central bank independence is critical to economic stability.

If the U.S. compromises that independence, the effects could be felt worldwide — impacting markets, currencies, and investors alike.

FAQs

1. Can a U.S. president fire the Federal Reserve chair?

Technically, it’s difficult but not impossible. Legal battles would almost certainly follow, especially if Trump tries to remove Jerome Powell.

2. How would lower interest rates affect inflation?

Cutting rates too quickly can fuel consumer spending, leading to higher demand and potential price spikes.

3. Why does the Fed’s independence matter?

The Fed’s credibility relies on making data-driven decisions, not political ones. Political control could undermine global confidence in the U.S. economy.

4. Could Trump’s policies cause a recession?

Yes, if markets lose trust in U.S. monetary policy, it could lead to capital flight, a weaker dollar, and potential global instability.