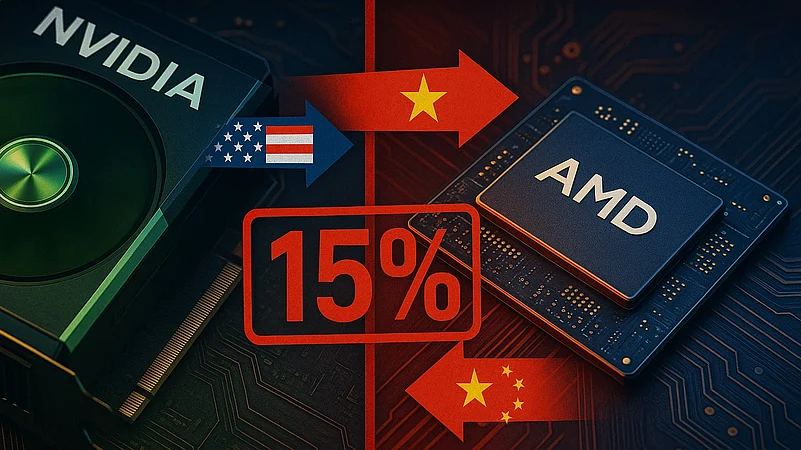

Nvidia reports Q2 earnings with $46.7B in revenue but misses China sales due to US export restrictions and a pending 15% pay-to-play policy. Here’s how Trump’s trade war, AI chip bans, and new product plans affect Nvidia’s future.

Table of Contents

🔥 Nvidia Struggles in China While Waiting on US 15% Plan!

Introduction

Nvidia, the world’s most valuable chipmaker and the $4 trillion AI powerhouse, just reported its Q2 2025 earnings — and while revenue surged 56% year-over-year to $46.7 billion, Wall Street wasn’t impressed. Shares dipped 3.5% after hours as the company missed out on billions in China sales due to ongoing US export restrictions and the pending 15% pay-to-play licensing plan under President Donald Trump’s administration.

With China accounting for nearly 13% of Nvidia’s revenue last year, these restrictions come at a critical time for the company and the global AI race. This earnings report sheds light on the challenges ahead, including Trump’s shifting trade policies, US-China chip wars, and the future of Nvidia’s dominance in AI infrastructure.

1. Nvidia’s Q2 2025 Earnings Snapshot

Nvidia reported better-than-expected revenue and profits, but slowing growth rates sparked concerns:

| Metric | Q2 2025 | Analyst Estimate | YoY Change |

|---|---|---|---|

| Revenue | $46.7B | $46.0B | +56% |

| Net Income | $26.4B | $24.7B | +59% |

| YoY Revenue Growth | 56% | Last year: 122% | ↓ Slowing |

| YoY Profit Growth | 59% | Last year: 168% | ↓ Slowing |

| Stock Price Reaction | -3.5% after hours | — | Negative |

Key takeaway: Despite delivering massive numbers, Nvidia’s slower growth and China sales challenges are making investors nervous.

2. Why Nvidia Missed Out on China Sales

Nvidia’s H20 AI chips, designed specifically for China to comply with earlier US trade restrictions, couldn’t be shipped this quarter.

The Key Issues:

- Export Controls: Trump’s administration halted advanced AI chip sales to China.

- Pending Guidelines: Nvidia agreed to pay the US government 15% of its China chip sales for an export license, but regulatory clarity is missing.

- China’s Response: Beijing is delaying approvals, citing national security risks.

This resulted in zero sales of H20 chips to Chinese clients in Q2, costing Nvidia billions in lost revenue.

3. Trump’s 15% Pay-to-Play Plan Explained

President Trump’s administration introduced an unprecedented policy requiring chipmakers like Nvidia and AMD to pay the US government 15% of China sales in exchange for export licenses.

However, guidelines remain unclear, meaning Nvidia can’t restart sales until the rules are finalized. CFO Colette Kress estimates:

“If geopolitical issues subside, we should ship $2B to $5B in H20 revenue in Q3.”

This policy reflects a broader tech weaponization strategy where the US is leveraging chip exports to maintain leadership in AI and advanced computing.

4. Nvidia’s China Challenge

China represents the world’s second-largest computing market and home to AI researchers driving innovation. Losing access could have long-term consequences:

- 13% of Nvidia’s 2024 revenue came from China

- $50B annual AI chip opportunity in China alone

- Competitive risk from domestic Chinese chipmakers

Nvidia’s CEO Jensen Huang has warned repeatedly:

“If American tech companies are blocked from China, Chinese developers will create their own alternatives, and the US could lose leadership in AI.”

5. AI Boom vs. AI Bubble

Nvidia sits at the center of the AI revolution, powering most data centers, generative AI models, and machine learning applications. Yet, experts warn that an “AI bubble” may be forming:

- Sam Altman (OpenAI CEO): Warned earlier this month that AI valuations may be overheating.

- MIT Researchers: Found most AI companies aren’t yet profitable despite massive investments.

- Market Volatility: Nvidia’s $4 trillion market cap means even slight growth slowdowns can trigger sharp stock corrections.

6. Nvidia’s Roadmap: New Chips & Big Bets

Despite regulatory setbacks, Nvidia is doubling down on innovation:

- B30 AI Chip for China: Designed to comply with US export rules while satisfying Beijing’s regulations.

- Blackwell Architecture Chips: Nvidia hopes to secure US approval for shipments of these next-gen AI chips to China.

- $3T to $4T AI Infrastructure Spending: Nvidia expects to benefit massively as global AI investments surge.

Investor Insight: Analysts believe Nvidia’s long-term growth story remains intact, provided export restrictions ease and next-gen products hit the market.

7. Market Impact & Investor Concerns

Nvidia’s stock rose over 30% in 2025, becoming the world’s first $4 trillion public company. But analysts warn volatility will continue:

“Nvidia’s shares could be muddied because of Trump’s on-again, off-again export controls,”

— Paul Meeks, Freedom Capital Markets

If China access is restored, Nvidia’s Q3 revenue could surge by $2B–$5B. But prolonged tensions risk:

- Losing market share to AMD and Chinese chipmakers

- Margin compression due to pay-to-play fees

- Delays in next-gen chip rollouts

8. What This Means for the AI Industry

Nvidia isn’t just a chipmaker; it’s the backbone of the AI economy. Any slowdown in its growth has ripple effects:

- Data centers could face chip shortages

- Generative AI companies may see cost increases

- Investors may reassess AI-driven valuations

If Nvidia successfully navigates these policy hurdles, it could strengthen its dominance. But failure to resolve China export issues could open the door for domestic Chinese chipmakers to capture the market.

FAQs

Q1. Why did Nvidia’s stock drop after earnings?

Because the company missed out on China sales, growth slowed compared to last year, and Wall Street expected a bigger revenue beat.

Q2. What is the US 15% pay-to-play plan?

It’s a Trump administration policy requiring chipmakers like Nvidia and AMD to pay 15% of China sales to the US government in exchange for export licenses.

Q3. How important is China to Nvidia’s business?

China accounts for 13% of Nvidia’s annual revenue and represents a $50B AI chip opportunity.

Q4. Is Nvidia making a new chip for China?

Yes, Nvidia is reportedly developing the B30 AI chip, designed to comply with US rules while meeting China’s needs.

Q5. Will Nvidia continue to dominate the AI market?

If export restrictions ease and Nvidia executes on its B30 and Blackwell chips, it could retain leadership. However, prolonged trade tensions could benefit rivals like AMD and Chinese chipmakers.