Trump’s latest attack on Fed Chair Powell is being shrugged off by markets. But could it backfire? Find out why investors are staying unshaken—for now.

Table of Contents

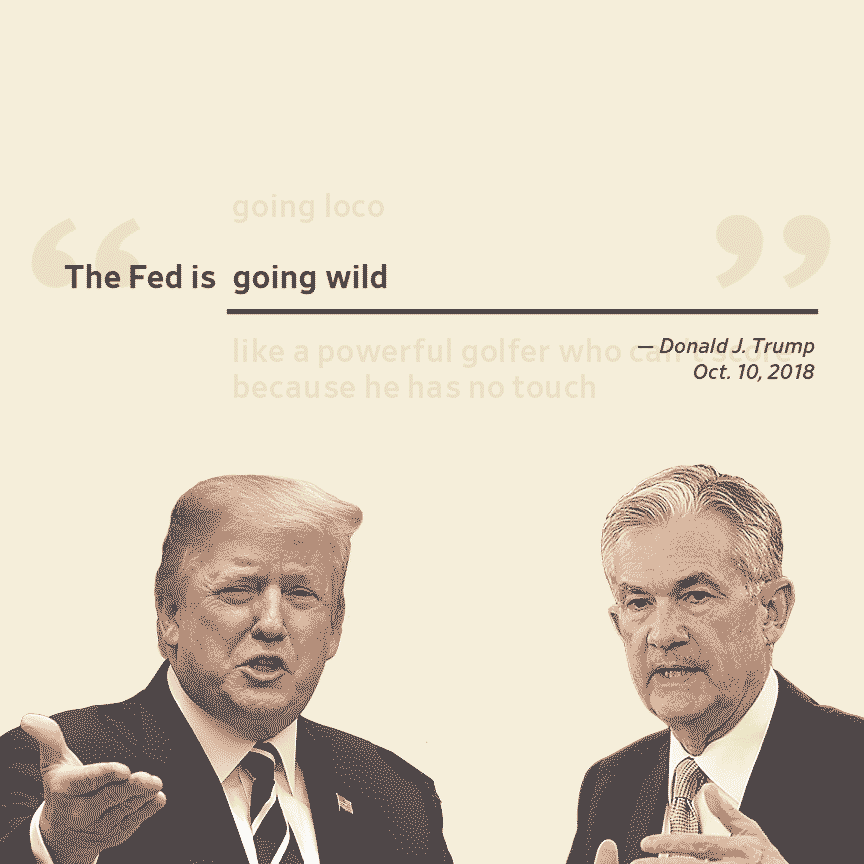

Trump Targets Powell—But It Could Make Things Worse

This past weekend, President Trump hit financial markets with a potent combo: 30% tariffs on major trade partners and a full-frontal assault on Federal Reserve Chair Jerome Powell. Yet come Monday, markets barely blinked.

Wall Street’s response? A collective shrug—savvy observers call it the “TACO trade”: Trump Always Chickens Out. Investors are betting the president will once again retreat, especially when confronting markets this week amid strong earnings and solid economic signals.

Below, we dive into why markets are staying calm, what could disrupt the status quo, and why Trump’s pressure on Powell might ultimately boomerang.

🇺🇸 1. Trump’s Powell Pressure + Tariff Threats

Over the weekend, Trump slammed 30% tariffs on imports from Canada, the EU, Mexico, and beyond—triggering renewed tension in global trade.

Simultaneously, OMB Director Russell Vought accused Powell of legal violations and lying to Congress regarding the $2.5 billion Fed HQ renovation, hinting at possible removal. Yet White House officials tell CNN there’s still no active plan to fire Powell—Trump reiterated he’s not currently seeking to remove him .

Still, the smokescreen is clear: a test to see how far they can push before shaking markets and forcing Powell’s hand.

💹 2. Wall Street’s TACO Trade Keeps Calm

Monday brought minimal market fallout: the S&P and Nasdaq closed slightly higher or flat; the Dow sat near record highs .

Economics professor Lawrence White summed it up: “Something egregious is needed”—only then will markets react. They’re betting Trump chickens out again.

This complacency fuels more emboldened Trump theatrics—yet it carries a hidden risk: if no resistance emerges, political pressure may grow.

🌪 3. The Boom-Bust Risk

Analysts caution rides like this may collapse without warning:

- FT warns complacency is dangerous: tariffs, Fed meddling & rising deficits could erode confidence and spur volatility .

- Reuters notes tariffs serve more headline than economic function—but markets remain unshaken—for now .

- MarketWatch and Business Insider warn that if Trump breaks pattern on tariffs or the Fed, investor missteps could turn a calm rally into a panic selloff.

🏛️ 4. Powell’s Response & Fed’s Backstop

The Fed reacted swiftly:

✅ Issued a detailed FAQ defending HQ expenditures.

✅ Powell requested a review by the Fed’s inspector general .

This quiet confidence signals to markets that the Fed remains independent.

Should Trump fire Powell—or install a “shadow chair”—markets may see sharp selloffs and bond yields spiking.

🔍 5. What Could Trigger a Market Breakdown?

Signs that could break the pattern:

- Tariffs actually implemented beyond bluff stage.

- Federal action against Powell (even an inquiry) that questions Fed autonomy.

- Upcoming Fed chair vote in May 2026—heightened uncertainty could unsettle markets.

✅ Key Takeaways

- Markets remain chill thanks to the TACO trade and robust Q2 earnings season.

- Trump’s attacks risk backfiring—political interference might stiffen Powell’s resolve and spook investors.

- Tariffs + Fed meddling remain a key risk combo.

- Watch for escalation: tariffs enacted, Fed investigations, or 2026 chair uncertainty could break the calm.

📌 Must Read

📌 Must Read = Nvidia to Restart AI Chip Sales to China After U.S. Reversal

📌 Must Read = Trump Announces Indonesia Trade Deal — No Details Yet

📌 Must Read = Nvidia to Restart AI Chip Sales to China After U.S. Reversal

📌 Must Read = JPMorgan’s Dimon Warns: Don’t Play with Fed as Powell Faces Pressure

❓ FAQ

Q: What’s the TACO trade?

The idea that Trump “Always Chickens Out” when markets react badly—so traders buy the dip expecting retreat.

Q: Can Trump fire Powell?

Legally only “for cause.” The renovation issue is being examined, but without conclusive proof it’s unlikely—markets call bluff for now .

Q: Should investors worry?

Not yet—but a sudden move on tariffs or the Fed could trigger rapid sell-offs, inflation, and rising bond yields.