The Bank of England is likely to cut rates from 4.25% to 4.0% on August 7, with more cuts expected. Discover how this affects your mortgage, savings, and when to act in 2025.

Table of Contents

🔼 BoE Set to Cut Rates in August—What UK Borrowers & Savers Must Know

🌍 Why It Matters Now

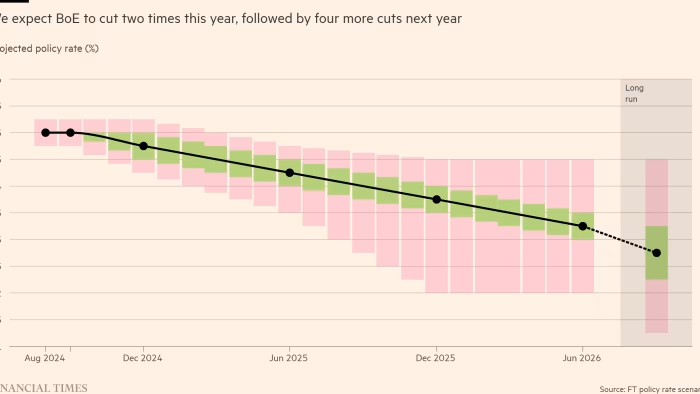

- Economists forecast the Bank Rate to fall to 4.0% at the August 7 MPC meeting, and potentially to 3.5% by year-end, driven by weakening labor data and cooling growth.

- Policymaker Alan Taylor notes a risk of not achieving a “soft landing,” and supports up to five quarter-point cuts in 2025.

- The broader cycle began with cuts from 5.25% → 5% (Aug ’24) → 4.75% (Nov ’24) → 4.5% (Feb ’25) → 4.25% (May ’25).

📉 What This Means for You

| Financial Area | Effect of Cut to 4.0% | Recommended Action |

|---|---|---|

| Mortgages | Tracker/SVR mortgages become cheaper; 1.6M fixed deals expire in 2025 | Remortgage early; compare fixed vs tracker |

| Savings Accounts | Easy-access and fixed rates may decline | Lock in current high rates now |

| Fixed-rate Deals | New two-year fixes could drop to ~3.5–3.6% | Actively compare lenders ahead of cuts |

| Investment Options | Bond yields may soften; property may gain affordability | Stay diversified; review portfolio |

| Borrowing Costs | Business and consumer loans may ease | Consider refinancing or new credit |

🔍 What You Should Do Now

- **Check mortgage deal expiry ** – lock in a new rate before August if you’re leaving a deal.

- Secure savings today – open fixed-term accounts now while rates are strong.

- Track bond and property funds – lower yields may influence allocations.

- Diversify smartly – consider TIPS-like assets or stable equities.

- Stay informed – watch the August 7 MPC meeting and September bond-sale targets

🤔 FAQs

Q1. Will my fixed-rate mortgage drop immediately with a base-rate cut?

No—most fixed deals remain constant. Trackers and SVRs will fall in line; only new fixed products may change .

Q2. By how much could savings rates fall?

If BoE cuts by 0.25 ppt, easy-access rates could drop ~0.2 to 0.3%; fixed-term yields will shift gradually .

Q3. Will there be more rate cuts?

Yes—markets expect cuts in August, November, and possibly early 2026, easing to ~3.5%–4%

✅ Final Takeaway

The anticipated August rate cut marks a pivotal moment for UK finances.

If you’re remortgaging, saving, or investing, now’s the time to act.

Be proactive—lock deals early, secure rates, and plan for diversification before the downward ride begins.

👉 Get started today:

- Compare mortgage options

- Open high-yield savings

- Rebalance your portfolio